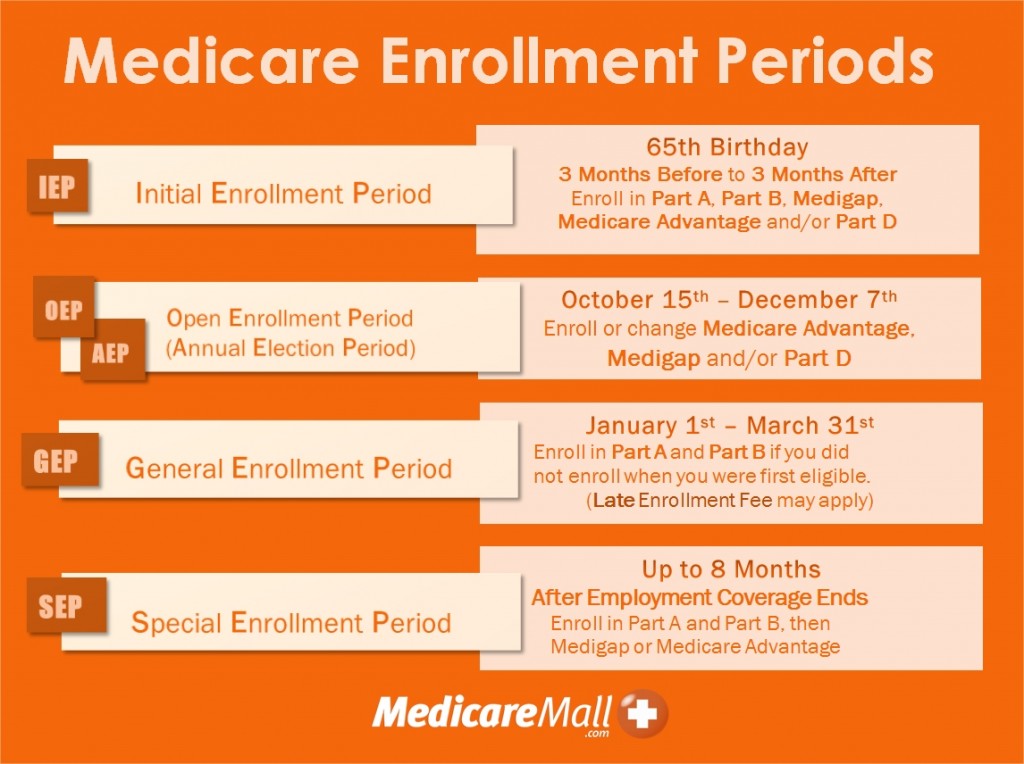

The Oct. 15-Dec. 7 Medicare Open Enrollment Period (OEP) is an excellent opportunity to make certain changes or improvements to your current Medicare coverage.

Also known as the Medicare Annual Election Period (AEP), Open Enrollment may be your only opportunity to make the Medicare changes you want until next year’s Open Enrollment Period begins 12 months from now. It is important to evaluate your current coverage, because failing to do so could cost you thousands of dollars over the course of the next year.

You are not obligated to make any changes to your coverage during the Oct. 15-Dec. 7 Medicare Open Enrollment Period, but if you are currently enrolled in Original Medicare Part A and Part B, these are your options to consider.

Sticking with Original Medicare

You have the option of continuing to roll the dice with Original Medicare. But keep in mind that both Medicare Part A and Medicare Part B are noted for getting money out of your pocket. It is possible to pay the Part A deductible, currently $1,184, more than once a year, and a long period of hospitalization, if your only coverage is Original Medicare, can bleed your bank account dry. As far as Medicare Part B is concerned, you can expect to contribute 20 percent out-of-pocket toward most of your Medicare-covered medical costs.

Enrolling in a Medicare Advantage Plan

With Medicare Advantage you’ll continue to pay your Medicare Part B premium. Depending on the Medicare Advantage plan you select, you will pay an additional, affordable premium or possibly no additional premium at all. With Medicare Advantage you will have the equivalent of your full coverage under Original Medicare, plus whatever additional coverage is specified in your plan. Medicare Advantage plans normally cover some of the costs you would have to pay out-of-pocket under Original Medicare. Medicare Advantage plans also typically offer coverage in areas not covered by Medicare Part A and Part B. Areas of coverage can include vision and hearing health, and most Medicare Advantage plans include prescription drug coverage.

While Original Medicare often requires you to pay high deductible, copay, and coinsurance costs, Medicare Advantage plans often require only modest copayments. As a result, Medicare Advantage is a highly affordable option for many Medicare recipients, and the choice of about 28 percent of people currently enrolled in Medicare.

Medicare Advantage is primarily a network-based option, with most plans requiring you to see doctors and providers within the plan’s network. However, some Medicare Advantage plans, such as PPOs (Preferred Provider Organizations) and, especially, PFFS (Private Fee-for-Service) plans, normally provide greater flexibility and more options.

Availability of plans varies from area to area, as do rates—even for the same plan within the same area. As a result, it is necessary to check out the various Medicare Advantage plans available in your area, compare what they do and do not cover, and find the lowest rate for the plan you choose.

Enrolling in a Medicare Supplement Plan

While Medicare Advantage replaces Original Medicare, a Medicare supplement plan is designed to fill the gaps in Original Medicare. This is why Medicare supplement insurance is often called Medigap.

There are 10 supplement plans on the market, from Medigap Plan A to Medigap Plan N. Each plan has fixed monthly premiums and its own degree of coverage. Monthly premiums often run from $100-$200 for a nonsmoking 65-year-old.

Medigap is noted for flexibility, as Medicare supplement plans allow you to see a wide range of healthcare providers. You are not limited to a network of providers. If you are a traveler, this is an important consideration.

The most popular, and most comprehensive, Medicare supplement plan is Plan F, which is designed to fill all the high-risk gaps in Original Medicare coverage. With Plan F there is no worry about having to pay out of pocket for any Medicare-approved hospital or medical costs, including deductibles, copayments, and coinsurance charges. Plan F covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B, and is an excellent investment for people with fixed incomes.

As with Medicare Advantage, it is important to compare rates, which can vary widely from company to company, before selecting a Medicare supplement plan.

Enrolling in a Medicare Part D Prescription Drug Plan

While a Medicare supplement plan is an excellent investment, it will not cover prescription drugs. As a result, enrolling in a Medicare Part D prescription drug plan (PDP) is another important move to consider during Medicare Open Enrollment.

Medicare Part D prescription drug plans are stand-alone, low-premium drug plans designed to help Medicare beneficiaries keep drug costs within their budget. People enrolled in Medicare Advantage plans that include drug coverage do not need to consider purchasing separate Part D plans, but for almost anyone else the investment is usually a wise one. Prescription drug costs can be a huge strain on a budget, and PDPs are an excellent, moneysaving solution.

For further assistance in choosing the right Medicare Plan during the Oct. 15-Dec. 7 Medicare Open Enrollment Period, contact a licensed, bonded MedicareMall Medicare plans representative today!

Which of these options are you planning to take during Open Enrollment? Please leave a comment!

© 2013 MedicareMall.com